TL;DR:

Furusato Nozei is Japan’s hometown tax program that lets residents donate to local municipalities in exchange for regional gifts and income/residence tax deductions. Even if your company handles your taxes, you can still participate using the One-Stop Exception. It’s a smart way to support rural Japan and reduce your taxes.

Navigating Japan’s tax landscape can be daunting, but there’s a silver lining: Furusato Nozei. This unique system not only allows you to support local communities but also rewards you with regional gifts and tax deductions. Let’s break it down:

What is Furusato Nozei?

Furusato Nozei (ふるさと納税), which translates to “hometown tax,” was established in 2008. It’s a program that lets taxpayers pre-pay their taxes by donating to municipalities of their choice (urban or rural), regardless of where they reside in Japan. In return, donors receive local specialties and can also claim tax deductions. The initiative aims to balance regional economies and address fiscal disparities between urban and rural areas.

Who Can Participate?

If you’re paying income and residential taxes in Japan, you’re eligible. This includes international residents with taxable income. In other words, as long as you’re living in Japan and earning enough to be taxed, you can take part — regardless of your nationality.

When to Donate and Tax Submission Timeline

- Donation Period: You can make donations anytime during the year.

- Tax Submission: Donations made within a calendar year (January 1 to December 31) are eligible for tax deductions in the following year’s tax return.

Where to Make Donations

You’re free to donate to any municipality across Japan. Many participants choose places with personal significance or regions offering appealing gifts. Platforms like Rakuten Furusato Nozei and Furusato Choice simplify the selection and donation process.

Why Does This Program Exist?

The program was introduced to support rural areas facing population decline and economic challenges. By allowing taxpayers to allocate funds to municipalities of their choice, it promotes balanced regional development and fosters a connection between urban dwellers and rural communities.

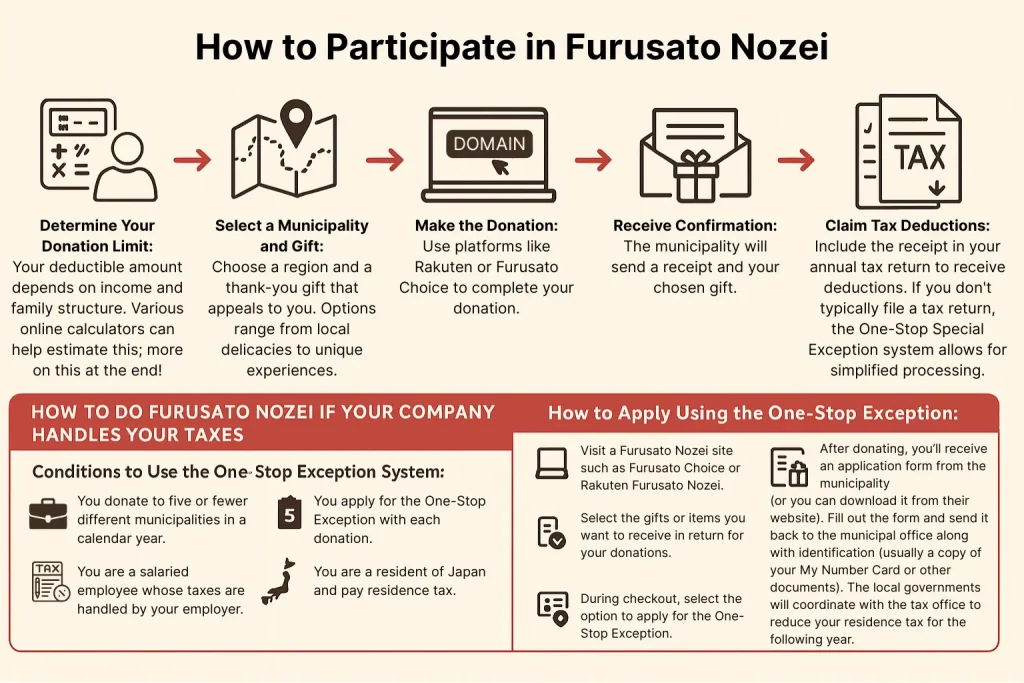

How to Participate

- Determine Your Donation Limit: Your deductible amount depends on income and family structure. Various online calculators can help estimate this; more on this at the end!

- Select a Municipality and Gift: Choose a region and a thank-you gift that appeals to you. Options range from local delicacies to unique experiences.

- Make the Donation: Use platforms like Rakuten or Furusato Choice to complete your donation.

- Receive Confirmation: The municipality will send a receipt and your chosen gift.

- Claim Tax Deductions: Include the receipt in your annual tax return to receive deductions. If you don’t typically file a tax return, the One-Stop Special Exception system allows for simplified processing.

How to Do Furusato Nozei If Your Company Handles Your Taxes

Conditions to Use the One-Stop Exception System:

- You are a salaried employee whose taxes are handled by your employer.

- You donate to five or fewer different municipalities in a calendar year.

- You apply for the One-Stop Exception with each donation.

- You are a resident of Japan and pay residence tax.

If all of these apply to you, you do not need to file a tax return (確定申告, kakutei shinkoku).

How to Apply Using the One-Stop Exception:

- Visit a Furusato Nozei site such as Furusato Choice or Rakuten Furusato Nozei.

- Select the gifts or items you want to receive in return for your donations.

- During checkout, select the option to apply for the One-Stop Exception (ワンストップ特例制度を申請する).

- After donating, you’ll receive an application form from the municipality (or you can download it from their website).

- Fill out the form and send it back to the municipal office along with identification (usually a copy of your My Number Card or other documents).

- That’s it. The local governments will coordinate with the tax office to reduce your residence tax for the following year.

What If You Donate to Six or More Municipalities?

In that case, you are not eligible for the One-Stop Exception. You will need to file a tax return (確定申告) yourself the following February-March. You may, however, donate multiple times to five or less municipalities, for example, 12 donations in total to five different municipalities is acceptable for the One-Stop Exception.

Result

If done correctly, you’ll see a reduction in your residence tax (住民税) starting in June of the following year. The system essentially lets you redirect part of your taxes to support rural areas—and get local goods in return.

Types of Gifts Available

The variety is vast and reflects Japan’s rich cultural tapestry:

- Gourmet Foods: Premium wagyu beef, fresh seafood, and seasonal fruits.

- Beverages: Regional sake, craft beers, and specialty teas.

- Handicrafts: Traditional pottery, textiles, and artisanal goods.

- Experiences: Travel vouchers, hot spring stays, and cultural workshops.

Popular Platforms for Furusato Nozei

- Rakuten Furusato Nozei: Offers a seamless donation experience with a wide selection of gifts.

- Furusato Choice: Provides extensive information on municipalities and their offerings.

- Direct Municipality Websites: Some regions have their own portals for donations, offering exclusive gifts.

Is Participating In Furusato Nozei Worth It for Me?

This is a major consideration as it isn’t always the ideal route for those interested in the program.

When Furusato Nozei Is Worth It

1. You Pay a Moderate to High Amount of Income and Residence Tax

If you’re a full-time salaried employee or have steady taxable income in Japan, Furusato Nozei offers real value. The more tax you pay, the more you can donate and receive back through deductions — minus a standard ¥2,000 administrative fee.

2. You Already or Plan To Purchase Regional or Gourmet Goods

Furusato Nozei gives you access to premium local products like wagyu beef, fresh seafood, seasonal fruits, sake, and specialty crafts. If you’re looking to buy items offered by different prefectures(perfect for gifts!), this is a great option to consider.

3. You Want to Support Rural Communities in Japan

Furusato Nozei was created to address rural population decline and financial imbalance between urban and regional areas. Participating helps you redirect a portion of your taxes directly to towns that need support.

When Furusato Nozei May Not Be Worth It

1. You Pay Little to No Tax in Japan

If you’re a student, newly arrived resident, or part-time worker with low income, your eligible donation cap may be too small to make the program worthwhile. The benefits depend on how much residence and income tax you pay.

2. You Plan to Leave Japan Before the Following June

Residence tax deductions from Furusato Nozei are applied starting in June of the year after your donation. If you move away or leave Japan before then, you may not receive the benefit.

3. You Are Unable to Complete the Paperwork

To qualify for deductions, you must either:

- File a tax return, or

- Use the One-Stop Exception and donate to five or fewer municipalities while submitting the required forms.

- Failing to submit these forms disqualifies your donations from tax relief.

Additional Information & Tips

- Administrative Fee: The minimum ¥2,000 is non-deductible, serving as an administrative fee.

- Gift Value: Gifts are typically valued at around 30% of the donation amount.

- Donation Limits: Capped at 40% of income for income‑tax deduction and 20% of residence‑tax income for special deductions.

- Policy Updates: Starting October 2025, municipalities will be barred from running “point back” campaigns via third‑party donation platforms—any Furusato Nozei donations made through those sites with point incentives will no longer qualify for tax deductions. Traditional thank‑you gifts (local specialties, experiences, etc.) remain fully allowed, and points earned through ordinary commercial transactions (e.g., credit card rewards) are unaffected.

Participating in Furusato Nozei isn’t just optimizing your tax benefits; you’re actively contributing to Japan’s diverse regions and helping save towns that would disappear elsewise. It’s a win-win-win: support communities, enjoy exclusive gifts, and make your tax payments work for you.